CP503 (and other IRS letters you never want to get)

If you get an IRS letter, like a CP503, it is crucially important that you read it, then respond by the deadline. The letter will explain how to reply. If you agree you owe the money, pay it in full or set up a payment plan. If you dispute it, follow the procedures in the letter for what to do. Do not do nothing and hope it goes away. It won’t.

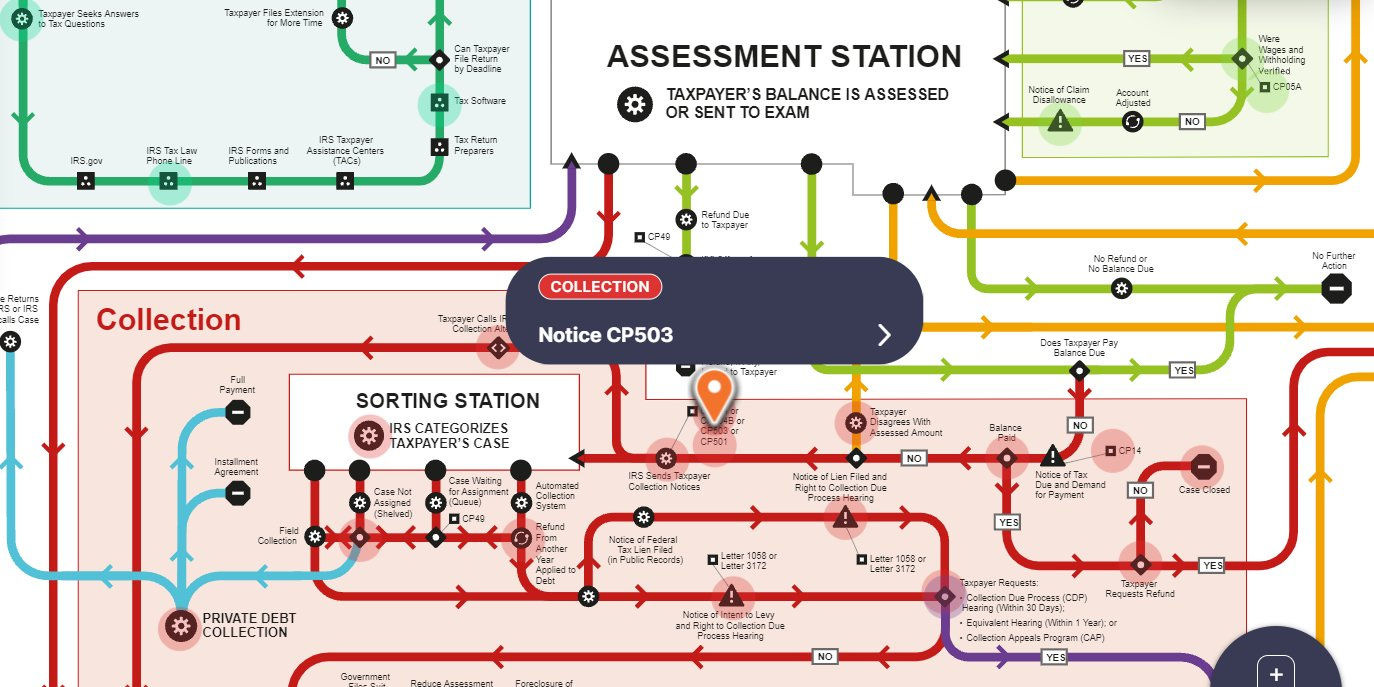

The absolute worst thing you can do is panic and ignore an IRS letter. If you do not respond, the process will move along inexorably to Collection,. You do not want that to happen. Really you don’t. Once it is in Collection the IRS can and routinely does take money out of bank accounts and seizes property. Yes, it has that power, and doesn’t need to ask for permission.

However, it never needs to end up that way. Instead, respond promptly and early, and always by the deadline specified in the letter.

A CP503 is a second notice letter. It means you didn’t respond to the first letter and it is now on Collection. It is now a speeding locomotive and hard to slow down. Some alternatives exist, like First Time Abatement for some penalties, taking it to Appeals or even Tax Court. An Enrolled Agent can represent you if dispute the IRS levy. But again, you MUST respond by the deadlines.

The notice number appears at the top of every letter. Go to the independent Taxpayer Advocate at the IRS, enter the notice letter. (Yes, it is indeed a bewildering flowchart.) However, it will explain what is happening and where you are in the process.

It’s important to realize many IRS notices are automated. The IRS matches up social security numbers on W-2s and 1099s against tax returns filed. If thre is a discrepancy, like a return should have had 2 W-2s and 3 1099s, and didn’t, an IRS letter goes out. For the most part this happens without humans being directly involved.

Which is exactly why you must respond by the deadline. If you don’t the automated process will just go to Collection.