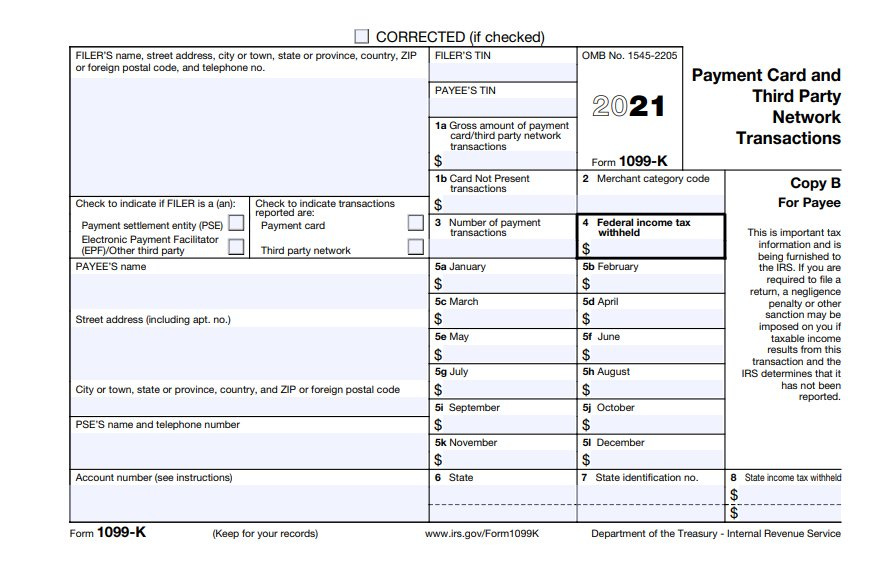

1099-K will report $600+ income for PayPal, eBay, Zelle, Venmo

Be prepared to carefully track payments on these platforms starting in 2022.

Starting in 2022, online selling and micropayment platforms will report yearly total income of more than $600 on form 1099-K. This is way down from the current 200 transactions a year totalling $20,000 or more. Many more 1099-Ks will be going out in 2023 for 2022 income. Be prepared!

Yes, it is quite possible some, maybe all, of that income will not be taxable. HOWEVER, be ready to prove to the IRS which portions of your 1099-K income are not taxable. Because the 1099-K implies all of it is.

Roommates

For example, if you have roommates and they routinely Zelle your their share of the rent every month, then you pay the full rent, these monthly transactions will look like businss tranactions. They aren’t. So keep detailed records and document everything, in case the IRS assumes it is income. Even better, find a different way to handle the rent.

The following applies to Zelle and Venmo too.

“Don’t accept nontaxable payments via credit or debit card

It may not be advisable to accept non-business payments using a card reader. For example, if you split the rent with your roommate, it’s probably not a good idea to have them pay you for their half using their debit card and a smart-phone card reader, because the processor will not be able to differentiate the payment and may issue a Form 1099-K including the rent payments.Splitting rent with your roommate is not generally a taxable transaction, but the IRS will probably send you a notice if you’re issued a Form 1099-K and that amount does not appear anywhere on your return.”

If you sell something on eBay for less than you paid for it, and many of us do, it’s not taxable. However, it will be reportable income on the 1099-K. So, again, document everything. If you sell on Etsy, IRS will assume it is a business and you will owe income tax plus self employment tax. This income, with expenses, gets reported on your Schedule C.

The first couple of years of the new 1099-K reporting criteria are probably going to be chaotic for taxpayers. Bottom line: If will be up to the taxpayer to show if 1099-K income is not taxable.